Every trading day presents new opportunities and challenges in the stock market. For investors and traders, being well-informed before the market opens is crucial. It helps in making educated decisions. In this blog, we will discuss 5 Things to Know Before The Stock Market Opens. This information can be the key to navigating the complexities of stock trading.

1. Overnight Market Activity

Understanding overnight market activity is vital. It sets the tone for the day. Markets around the world operate on different time zones. So, movements in Asian and European markets can impact U.S. markets. If overseas markets are up, it often signals a positive start in the U.S. Conversely, if they are down, caution may be warranted.

Asian and European Market Trends

| Region | Trend | Impact Level |

|---|---|---|

| Asia-Pacific | Upward | Moderate |

| Europe | Downward | High |

2. Economic Indicators

Economic indicators released before the market opens can greatly influence market sentiment. Indicators like GDP, unemployment rates, or inflation figures provide insights into the economy’s health. Positive data can boost market confidence. Negative data can lead to caution or sell-offs.

Key Economic Indicators

| Indicator | Expected Value | Impact on Market |

|---|---|---|

| GDP Growth Rate | 2.5% | Positive |

| Unemployment Rate | 5% | Negative |

3. Corporate Earnings Reports

Earnings season can be a significant driver of stock prices. Companies releasing their earnings reports before the market opens can cause big moves. Positive earnings can lead to stock surges. Disappointing results can trigger sell-offs.

Major Earnings Reports

| Company | Earnings Expectation | Market Reaction |

|---|---|---|

| TechCorp | Above Expectations | Positive |

| AutoMobiles | Below Expectations | Negative |

4. Political and Global Events

Keep an eye on political and global events. These can have a direct impact on markets. Elections, trade agreements, or geopolitical tensions can influence investor sentiment. They often result in increased volatility.

Recent Global Events

| Event | Market Impact |

|---|---|

| Election Outcome | High Volatility |

| Trade Agreement | Positive Outlook |

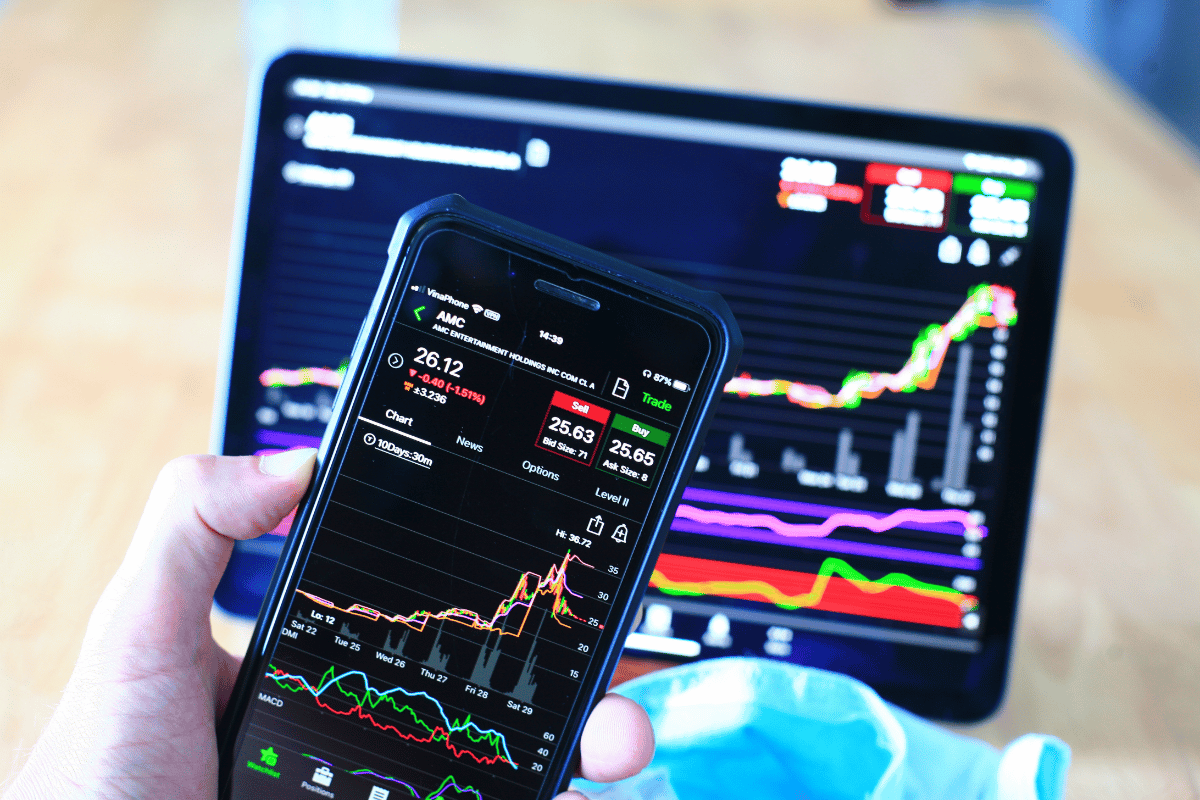

5. Futures Market Data

Futures markets provide an early indication of market sentiment. If futures are up, it often suggests a positive opening. If they are down, the market might open lower. This information can be pivotal for day traders.

Futures Market Overview

| Index | Futures Trend | Opening Indication |

|---|---|---|

| Dow Jones | Upward | Positive Opening |

| NASDAQ | Downward | Negative Opening |

Frequently Asked Questions

What is the best time to check these indicators?

The optimal time to review these indicators is early in the morning, before the market opens. This ensures that you have the most current information.

How do global events affect the stock market?

Global events can cause uncertainty or confidence in markets. Elections or trade deals can alter economic forecasts. This changes investor behavior.

Are earnings reports more important than economic indicators?

Both are important. Earnings reports reflect individual company performance. Economic indicators show the broader economy’s health. They complement each other in analysis.

Can overnight market activities always predict the market opening?

Not always. They provide a hint but are not foolproof. Many factors can influence the market after opening.

Conclusion

In conclusion, being informed about these 5 Things to Know Before The Stock Market Opens. It is essential for successful trading. Overnight market activities, economic indicators, corporate earnings reports, political and global events, and futures market data all play a crucial role. By understanding these elements, you can make more informed decisions, anticipate market movements, and potentially improve your investment outcomes. Remember, knowledge is power in the world of stock trading. Stay informed, stay ahead.