In the complex world of finance, the inverted yield curve stands out as a critical indicator, often heralding significant economic shifts. This phenomenon occurs less frequently but always commands the attention of investors, economists, and policymakers alike. In this blog post, we delve into the intricacies of the inverted yield curve, its implications, and its predictive power regarding economic trends.

The Anatomy of a Yield Curve

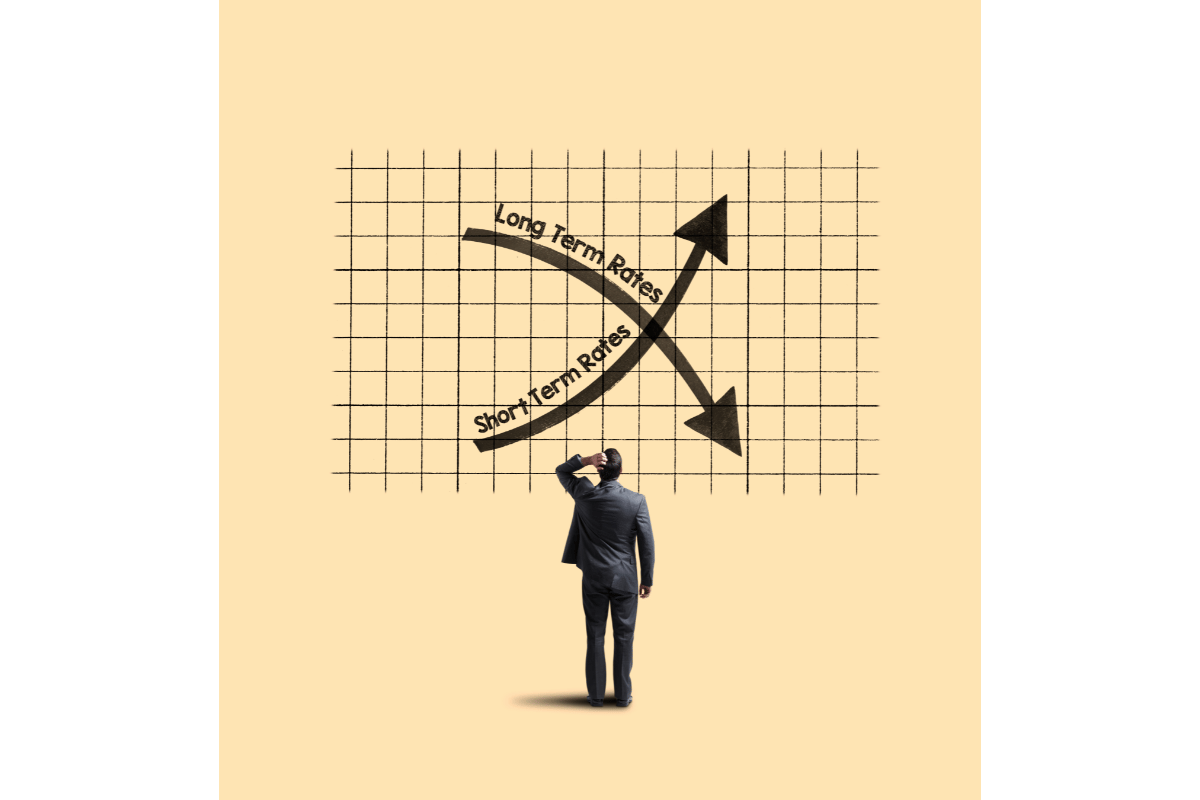

Traditionally, the yield curve represents the relationship between interest rates and the time to maturity of debt securities issued by a sovereign entity, such as U.S. Treasury bonds. Under normal circumstances, longer-term bonds yield higher returns than shorter-term bonds, reflecting the increased risk and time value of money associated with extended investment periods. This relationship typically produces an upward-sloping curve.

Understanding the Inverted Yield Curve

An inverted yield curve occurs when short-term interest rates exceed long-term rates, leading to a downward-sloping curve. This inversion is not just a quirk of financial markets; it’s a phenomenon loaded with economic implications.

A Detailed Exploration: The Inverted Yield Curve Phenomenon

| Maturity Term | Normal Yield (%) | Inverted Yield (%) |

|---|---|---|

| 3-month | 1.5 | 2.5 |

| 2-year | 2.0 | 2.0 |

| 5-year | 2.5 | 1.8 |

| 10-year | 3.0 | 1.6 |

| 30-year | 3.5 | 1.5 |

This table illustrates a typical inversion scenario where short-term yields surpass those of longer maturities, signaling investor skepticism about near-term economic prospects.

Frequently Asked Questions About Inverted Yield Curves

What Causes an Inverted Yield Curve?

An inverted yield curves typically emerges from a confluence of factors, including investor expectations of economic slowdown, policy decisions by central banks affecting short-term interest rates, and shifts in demand for long-term versus short-term bonds.

Is an Inverted Yield Curve a Reliable Recession Predictor?

Historically, an inverted yield curves has been a remarkably reliable recession predictor, often preceding economic downturns. However, it’s not infallible and should be considered alongside other economic indicators.

How Does an Inverted Yield Curve Affect the Economy?

The inversion can lead to tighter credit conditions, as lenders become wary of long-term commitments at lower yields. This can slow down investment and consumer spending, contributing to economic contraction.

What Should Investors Do When the Yield Curve Inverts?

Investors often take a more cautious approach, seeking safer assets and diversifying their portfolios to mitigate potential risks associated with economic downturns.

Navigating the Signals of an Inverted Yield Curve

The inverted yield curves serves as a harbinger, prompting analysts to probe deeper into economic indicators. For those looking to understand the underpinnings of economic cycles, grasping the basics of bonds offers a solid foundation. Moreover, familiarizing oneself with the concepts of annual income and how to calculate it can provide personal financial clarity in uncertain times.

For individuals considering a pivot into finance, understanding what companies are in the finance field can open new career pathways. Additionally, exploring opportunities in sectors less affected by economic cycles, such as real estate investment trusts, might offer alternative investment avenues.

Conclusion

The inverted yield curve is more than a mere economic anomaly; it’s a signal that demands attention. It prompts us to question, analyze, and seek deeper insights into the economic and financial narratives unfolding before us. For those intrigued by the complexities of finance and eager to navigate these turbulent waters confidently, our platform offers a wealth of resources, from investment strategies to economic analysis. We invite you to explore our insights and join us in demystifying the financial landscapes that shape our world. Contact us to embark on a journey of financial empowerment and discovery.